About sales figures, equipment purchases, and other details that are not readily available to outsiders. It measures how much cash a firm makes after deducting its needed working capital and capital expenditures.

#Fixed assets turnover ratio formula free#

Free Cash FlowThe cash flow to the firm or equity after paying off all debts and commitments is referred to as free cash flow. Companies that issue shares of stock or equity to raise funds don’t have a financial obligation to pay those funds back to investors. The interest coverage ratio is a debt and profitability ratio used to determine how easily a company can pay interest on its outstanding debt. Fixed Asset Turnover Ratio Explained With Examples

#Fixed assets turnover ratio formula how to#

You will learn how to use its formula to evaluate a firm’s ability to pay off its long-term debt. Higher the proportion of assets that are illiquid, lesser the amount available for company’s other operations and working capital. A high FAT ratio does not tell anything about a company’s ability to generate solid profits or cash flows. revenue) in return from its long-term assets. Low Turnover → The company is NOT receiving sufficient value (i.e. It is important for companies to invest in their asset base to maintain business operations and growth. Trade Receivables or Debtors turnover ratio It indicates economy and efficiency in the collection of amount due from debtors.įixed assets need to be replenished and will increase in a growing company. Remember we always use the net PPL by subtracting the depreciation from gross PPL. A high turn over indicates that assets are being utilized efficiently and large amount of sales are generated using a small amount of assets.Īnalysis of Financial StatementsThe analysis of financial statements involves gaining an understanding of the financial situation of an organization by reviewing the organization’s financial statements. It is better to use this ratio and analysis within peers and the same industry group. Therefore, it would be futile to decide the standard ratio or proportion of fixed and current assets and compare across the industry segments. Hence a period on period comparison with other companies belonging to similar industries and seize is an effective measure to estimating a good ratio. Therefore comparing ratios of similar types of organizations is important. So, in this article, we learned about the fixed asset coverage ratio, and we discovered many other terms. Hence, it is always better for the analyst to do the in-depth analysis of the company’s performance rather to only rely on ratios. But in order to be useful, the ratio must be compared to industry comparables, or companies with similar characteristics as the target company, such as similar business models, end markets, and risks.Īs such, may not reflect the financial position of the company during other periods of the year. In particular, Capex spending patterns in recent periods must also be understood when making comparisons, since one-time periodic purchases could be misleading and skew the ratio. Despite the reduction in CapEx, the company’s revenue is growing – higher revenue is being generated on lower levels of CapEx purchases. The high ratio also represents a minimal risk that the company will suffer from any bankruptcy risk.

The ratio shows how much of the owner’s cash is tied up in the form of fixed assets such as property, plants and equipment.

8 and 1.1, the 1.4 ratio in the current period shows the company has improved its balance sheet by increasing assets or deleveraging–paying down debt.

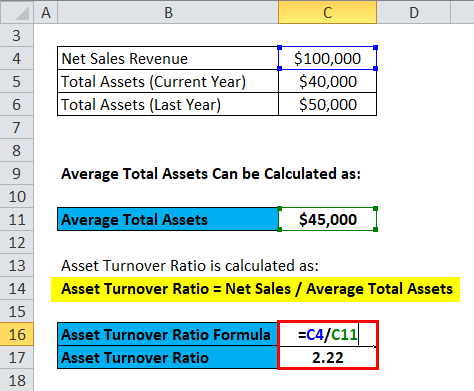

If Chevron’s ratio for the prior two periods was. The current ratio is a liquidity ratio that measures a company’s ability to cover its short-term obligations with its current assets. Below there is detailed information about the asset coverage ratio formula. If you want to calculate the fixed asset coverage ratio, then you need to use the formula.

We understood how to calculate the fixed asset coverage ratio and covered an example for more understanding. In general, the higher the fixed asset turnover ratio, the better, as the company is implied to be generating more revenue per dollar of long-term assets owned. Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company. And after this, you need to divide the remaining value with the total debt of the company. With the current ratio it is not the case of the higher the better, as a very high current ratio is not necessarily good.Īfter doing this, you need to minus the total asset with the total current liability that you calculated using the formula. These ratios are sometimes known as risk ratios, positioning ratios or solvency ratios. Gearing relates to an organisation’s relative levels of debt and equity and can help to measure its ability to meet its long-term debts.

0 kommentar(er)

0 kommentar(er)